U.S. Genotyping Market 2030: Pioneering Precision Medicine Through Genetic Insights

U.S. Genotyping Market Size & Trends

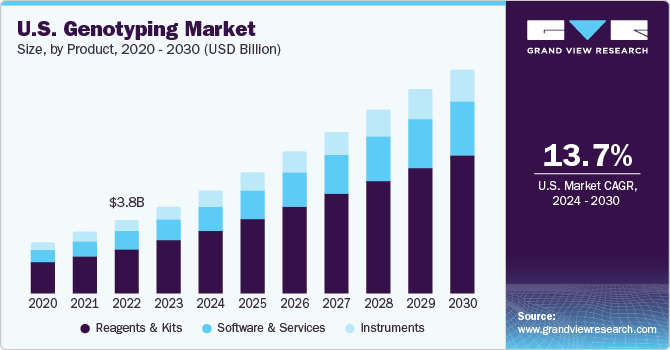

The U.S. genotyping market size was estimated at USD 6.42 billion in 2023 and is expected to grow at a CAGR of 13.7% from 2024 to 2030. Rising prevalence of genetic disorders & cancer, technological advancements, increased focus on developing personalized medicine, and increasing R&D funding for genomics are some of the key factors driving market growth. However, lack of skilled professionals and less awareness about advanced technological solutions in developing regions may hamper market growth.

The U.S. accounted for over 35.8% of the global genotyping market in 2023. The rise in chronic diseases like cancer and genetic disorders is anticipated to fuel the need for diagnostic testing based on genotyping. The World Health Organization reported that there were 19.1 million new cases of cancer worldwide in 2020. Viruses that cause cancer, such as the Human Papilloma Virus (HPV) and Hepatitis B and C Viruses (HBV/HCV), account for approximately 20% of cancer deaths globally. Predictions based on population growth and aging suggest that cancer cases will surge by about 70% in the coming two decades. The American Cancer Society reported that in the year 2023, the U.S. witnessed 1.9 million new instances of cancer and 609,820 fatalities due to the disease. Hence, the escalating cancer incidence is expected to propel the genotyping market significantly.

Gather more insights about the market drivers, restrains and growth of the U.S. Genotyping Market

Genotyping is widely used in the U.S. for a variety of purposes, such as drug discovery, personalized medicine, diagnostic research, and agriculture. In 2018, a new landmark in dairy genetics was achieved, as 2 million individual animal genotypes were recorded in the dairy database. Furthermore, strategic initiatives undertaken by local players are anticipated to contribute to market growth. In February 2021, an example of industry consolidation occurred when VG Acquisition Corp. joined forces with 23andMe, a genetics and research company based in the U.S. that specializes in providing genotypic solutions directly to consumers. This merger was expected to infuse their consumer health genetics business with additional capital funds. These factors are expected to propel market growth.

The local presence of key market players in the country is anticipated to increase the penetration of genotyping products. For instance, Roche provides genotyping products for cervical cancer diagnosis, such as cobas HCV GT. Furthermore, many academic institutes, research centers, and universities are collaborating with key market players to support genomic research programs. For instance, in December 2018, Illumina announced the contribution of its high-density genotyping array, Infinium, to three genome centers in the U.S. to support the “All of Us Research Program.”

The market is anticipated to grow, driven by an upsurge in funding from government entities and pharmaceutical & biotech firms, particularly for genomic studies. An example of this is the USD 28.6 million grant awarded by the National Institutes of Health (NIH) to the “All of Us Research Program” in September 2018. This funding was used to set up three genome centers across the U.S., focusing on precision medicine research. Furthermore, the COVID-19 pandemic has positively influenced the genotyping market by increasing the demand for COVID-19 genotyping kits. SNP genotyping has been utilized to identify genetic variations of COVID-19.

U.S. Genotyping Market Report Highlights

- Reagents & kits dominated the market and held the largest revenue share of 61.2% in 2023. This segment is also expected to grow at the fastest CAGR during the forecast period.

- Sequencing dominated this market and held the largest revenue market share of 21.5% in 2023 and is expected to grow at the fastest CAGR during the forecast period.

- Diagnostics and personalized medicine dominated the market and accounted for the largest revenue share of 33.8% in 2023. This is owing to the rising adoption of genotyping products for research and the increasing need to diagnose genetic diseases.

- Diagnostics and research laboratories dominated this market and held the largest revenue share of 36.3% in 2023 and is expected to grow at the fastest CAGR during the forecast period.

- In March 2024, Bio-Rad Laboratories, Inc. announced that the dd-Check STEC Solution received approval from AOAC INTERNATIONAL. This is the first Droplet Digital PCR method to be approved by AOAC.

U.S. Genotyping Market Segmentation

Grand View Research has segmented the U.S. genotyping market based on product, technology, application, and end-use:

Product Outlook (Revenue, USD Million, 2018 - 2030)

- Instruments

- Reagents & Kits

- Software and Services

Technology Outlook (Revenue, USD Million, 2018 - 2030)

- PCR

- Capillary Electrophoresis

- Microarrays

- Sequencing

- Mass Spectrometry

- Others

Application Outlook (Revenue, USD Million, 2018 - 2030)

- Pharmacogenomics

- Diagnostics and Personalized Medicine

- Agricultural Biotechnology

- Animal Genetics

- Others

End-use Outlook (Revenue, USD Million, 2018 - 2030)

- Pharmaceutical and Biopharmaceutical Companies

- Diagnostics and Research Laboratories

- Academic Institutes

- Others

Order a free sample PDF of the U.S. Genotyping Market Intelligence Study, published by Grand View Research.

Comments

Post a Comment