Investigational New Drug CDMO Market Investment Feasibility Analysis Report 2028

Investigational New Drug CDMO Industry Overview

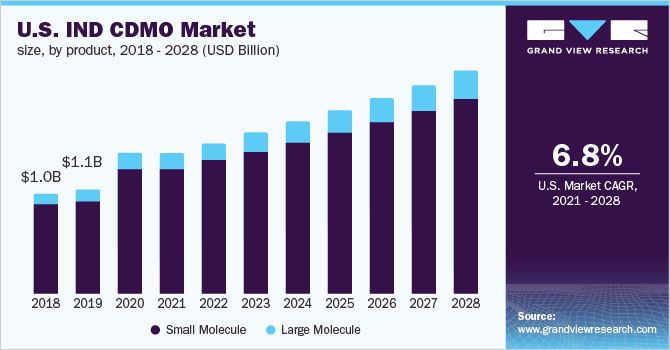

The global investigational new drug CDMO market size was valued at USD 4.2 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 6.9% from 2021 to 2028.

The market growth can be attributed to factors such as the increasing outsourcing services by pharmaceutical companies, rising R&D investments, and stringent regulations for conducting clinical studies. The FDA's role in the development of a novel drug begins when the drug's sponsor decides to test the new molecule's diagnostic or therapeutic potential in humans after screening it for pharmacological activity and acute toxicity potential in animals. The molecule then changes its legal position under the Federal Food, Drug, and Cosmetic Act, becoming a new drug subject to the drug regulatory system's specific requirements.

Gather more insights about the market drivers, restrains and growth of the Global Investigational New Drug CDMO Market

According to the post-pandemic pharmaceutical landscape, the industry would see a rise in innovation, with cancer and rare diseases expected to benefit the most. Due to the recent surge in investigational new drug (IND) applications, contract services are predicted to grow substantially, with an estimated 75 annual FDA approvals expected by 2025. From April 2020 to June 2020, the FDA received 3,806 IND applications, more than in the preceding eight years combined (3,576 in 2012-2019).

Besides, the FDA's expectations for new treatment drug development initiatives in the fight against COVID-19 are underlined in these two guidances, “COVID-19 Public Health Emergency: General Considerations for Pre-IND Meetings Requests for COVID-19 Related Drugs and Biological Products” and “COVID-19: Developing Drugs and Biological Products for Treatment of Prevention”.

According to this Pre-IND Guidance, all COVID-19 drug development interactions should be initiated through IND meeting requests, which were given to provide broad considerations to assist sponsors in developing Pre-IND meeting requests for COVID-19-related drugs. The FDA recommends that drug development applications be submitted through the Pre-IND programs rather than a pre-Emergency Use Authorization in order to improve the quality and content of IND submissions and streamline prospective sponsor bids.

The review and approval processes for IND applications and NDAs are continually evolving, thus influencing approval trends. In mid-2018, FDA Commissioner Scott Gottlieb declared plans to upgrade the agency’s office of drug review, and the agency issued draft guidance documents on the way the FDA would include patient input in regulatory decision-making. In reality, when it comes to regulatory approvals, the FDA has to take real-world evidence from off-label drug use into account. When evaluating drugs for approval, the FDA and other regulatory agencies take patient-reported outcomes into consideration.

Browse through Grand View Research's Medical Devices Industry Research Reports.

- Cosmetics Market - The global cosmetics market size was valued at USD 254.08 billion in 2021 and is anticipated to register a CAGR of 5.3% from 2022 to 2028.

- Pharmaceutical Logistics Market - The global pharmaceutical logistics market size was valued at USD 78.5 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 8.6% from 2022 to 2030.

Market Share Insights

- June 2021: Charles River Laboratories International, Inc. acquired Vigene Biosciences, Inc. The acquisition expanded its existing cell and gene therapy contract manufacturing capabilities and provided a complete gene-modified cell treatment solution in the U.S.

- May 2020: The FDA has issued two new guideline documents for industry and investigators of COVID-19 drugs and biological products.

Key Companies profiled:

Some prominent players in the global investigational new drug CDMO market include

- Covance Inc.

- Charles River Laboratories Inc.

- Cambrex Corporation

- IQVIA Holdings Inc.

- Syneos Health

- Lonza

- Catalent

- Recipharm AB

- Siegfried Holding AG

- Thermo Fisher Scientific Inc.

Order a free sample PDF of the Investigational New Drug CDMO Market Intelligence Study, published by Grand View Research.

Comments

Post a Comment